FINOPS – money first

I have already discussed the topic of cloud costs in a previous article. We showed you the different types of costs in the cloud and where and how you can save money. But how to manage it all and achieve efficient use of resources in such a dynamic environment as the public cloud? The answer is… FinOps!

Jakub Procházka

What is FinOps

Most of you have probably come across terms like DevOps, SecOps, DevSecOps and so on. But few people have probably come across the terms FinOps or even CapOps. What do they mean? Why do we add an Ops suffix to the traditional disciplines of development, security, financial or capacity management?

FinOps, or finance operations, is a relatively young discipline that deals with, as the name suggests, the financial side of the operating environment in the public cloud. This is a methodology that aims to keep track of costs and provide overall insight into the operating environment. At the same time, it provides valuable information on how much individual services and applications cost us.

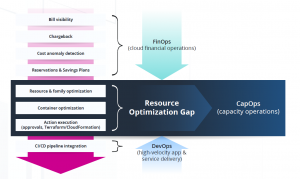

The relationship between FinOps, CapOps and DevOps is demonstrated in the image above. It shows that it belongs to finance operations:

- insight into invoicing,

- chargeback,

- anomalous cost analysis,

- reservations and savings plans.

Between the already classic (and in recent years very popular) DevOps and today discussed FinOps there is a partial gap, which is then trying to fill CapOpsor or capacity operations, i.e. managing the available resource capacity to match the actual needs of the operation.

Why should you care?

Clearly, the bigger the company, the harder it is to manage costs. This is doubly true in the context of the cloud. The simple investment model of purchasing has morphed into a dynamic marketplace with constant changes in prices, configurations and subscription volumes. It’s not just about the resources themselves, but also about improving company processes and achieving company goals.

We face several challenges such as:

- difficulty in identifying the origin of costs,

- allocation of costs within the organisation (cost centres),

- unexpected fluctuations in costs,

- reliable cost reduction,

- taking advantage of various discounts and savings,

- uncertainty as to whether the selected sources are optimal.

The benefits that a well-implemented FinOps brings us are:

- Insight – provides the company with insight into current costs and allocations.

- Cost Accountability – defines accountability by linking allocated resources and costs to existing projects and specific teams.

- Resource optimization – optimizes infrastructure utilization by changing, scaling, and removing existing resources.

- Governance – brings best practices to other future projects through applied policies and cost management strategies.

How to achieve your FinOps goals?

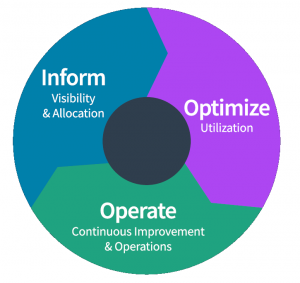

The FinOps lifecycle repeats itself in regular iterations. It can be divided into three successive phases:

- Inform

- Optimize

- Operate

Inform

Start with the people. It is about communicating directly with individual teams and the business to create shared responsibility for the resources consumed. The goal is to get accurate information about what the company is spending on, what they are making money on, and what efficiencies they are operating at.

Implement e.g. high quality invoice analysis, cost breakdown in different views across teams, cost centres or projects. Establish appropriate budgets.

Optimize

Then, process the information, allowing your teams to improve their work processes, uncover detailed insights into operations, and apply recommendations based on company goals.

Identify resource guzzlers, sources of provider billing fluctuations, outdated configurations, unused resources and untapped discounts, and plenty of other opportunities for cheaper operations.

Operate

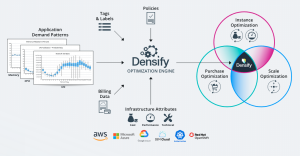

And finally… define and apply processes to provide continuity and structure. Add reliable technology. Finance Operations includes tools and platforms that enable your teams to do their jobs more efficiently. An example is the multi-cloud tool Densify, which we have been using at ORBIT for our clients for several years.

Let the tools calculate the optimal instances, configurations, container sizing, composition of saving plans and reservations. Introduce recommendation automation at the service order and deployment level using dynamicinfrastructure as a code.

How to start?

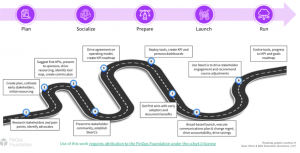

I probably won’t surprise anyone with this, but again, the first thing you’ll need is a plan. FinOps Foundations can significantly help you with adoption, on whose website you can find a well-developed framework. To give you an idea of what to expect on this journey, you can look at an example of an adoption roadmap.

When adopting FinOps, there are six basic principles to keep in mind, based on the defined framework, that you can’t do without:

- Teams need to work together.

- Decisions are driven by the business value of the cloud.

- Everyone takes responsibility for the resources they consume.

- FinOps reports should be accessible and well timed.

- The management team must be centralised.

- Think of variable pricing in the cloud as an advantage that works for you.

Who’s gonna do it?

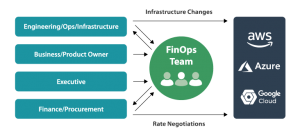

As stated in the first principle, teams must work together. For finance operations to work properly, we will need all of these roles:

The following diagram illustrates an application of the FinOps model where the FinOps team (sometimes referred to as a cloud cost center of excellence) works with the rest of the company to manage cloud strategy, governance and best practices so that the rest of the organization can benefit from moving applications to public clouds.

Tools that can help you

There are plenty of tools on the market to help with cost management. In ORBIT we use very progressive Densify. This tool provides not only bill reader functionality, but more importantly, advanced optimization recommendations that recommend the ideal resource for a given workload based on measured metrics and using set policies and artificial intelligence.

Each public cloud provider also offers its own more or less sophisticated tools that can help users with FinOps. I have already mentioned most of them in my previous article on costs (e.g. AWS CloudWatch,Azure Advisor, tags, various calculators, etc.).

Where to next?

Are you interested in the idea of finance operations and want to learn more? In that case, I can recommend finops.org, which is run by the Linux Foundation’s FinOps Foundation. Or this interesting article with a nearly hour-long video in whichDensify colleagues break down FinOps and tools in greater detail.

You can also find lots of other interesting cloud articles and tips in our cloud encyclopedia.

This is a machine translation. Please excuse any possible errors.